In Austria, starting from January 1, 2024, there will be no VAT for the acquisition, imports, and installations of PV modules.

Key Facts at a Glance:

- Period: from January 1, 2024, to December 31, 2025

- Capacity: the PV system must not exceed a peak capacity of more than 35 kWp.

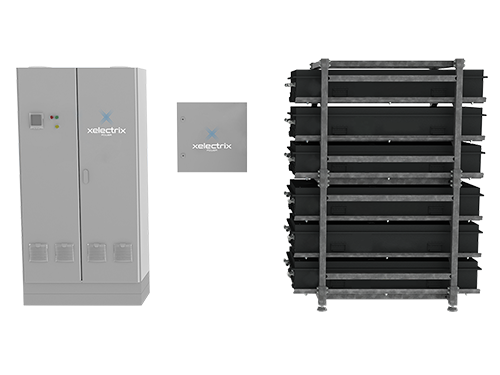

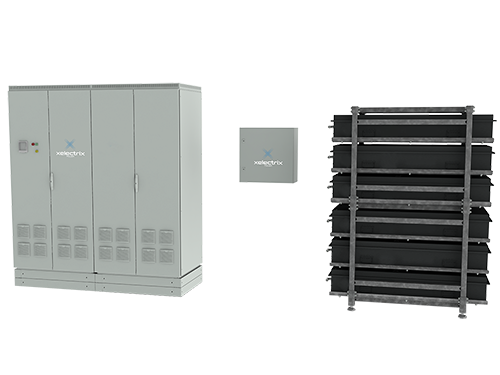

- Storage: when installed as part of the PV system, storage is considered an ancillary service (along with mounting systems, energy management systems, solar cables, etc.) and is also exempt from VAT. A suitable storage solution from xelectrix for this purpose would be the BASIC SPLIT ECO.

- For all types of usage: whether you use the generated electricity for self-consumption, feed it into the grid, or operate in island mode - the zero tax rate applies to all usage types.

- Expansion of systems: the zero tax rate applies only to PV modules delivered, intra-community acquisitions, imports, or installations from January 1, 2024. Expansions of systems are eligible as long as the total capacity does not exceed 35 kWp.

- Repairs and spare parts: Repairs are not eligible, but spare part deliveries are.

For more information, visit the Federal Ministry: Link